Accountants and Tax Advisors in Kent & South East England Serving Kent and the South East with Expert Financial Solutions

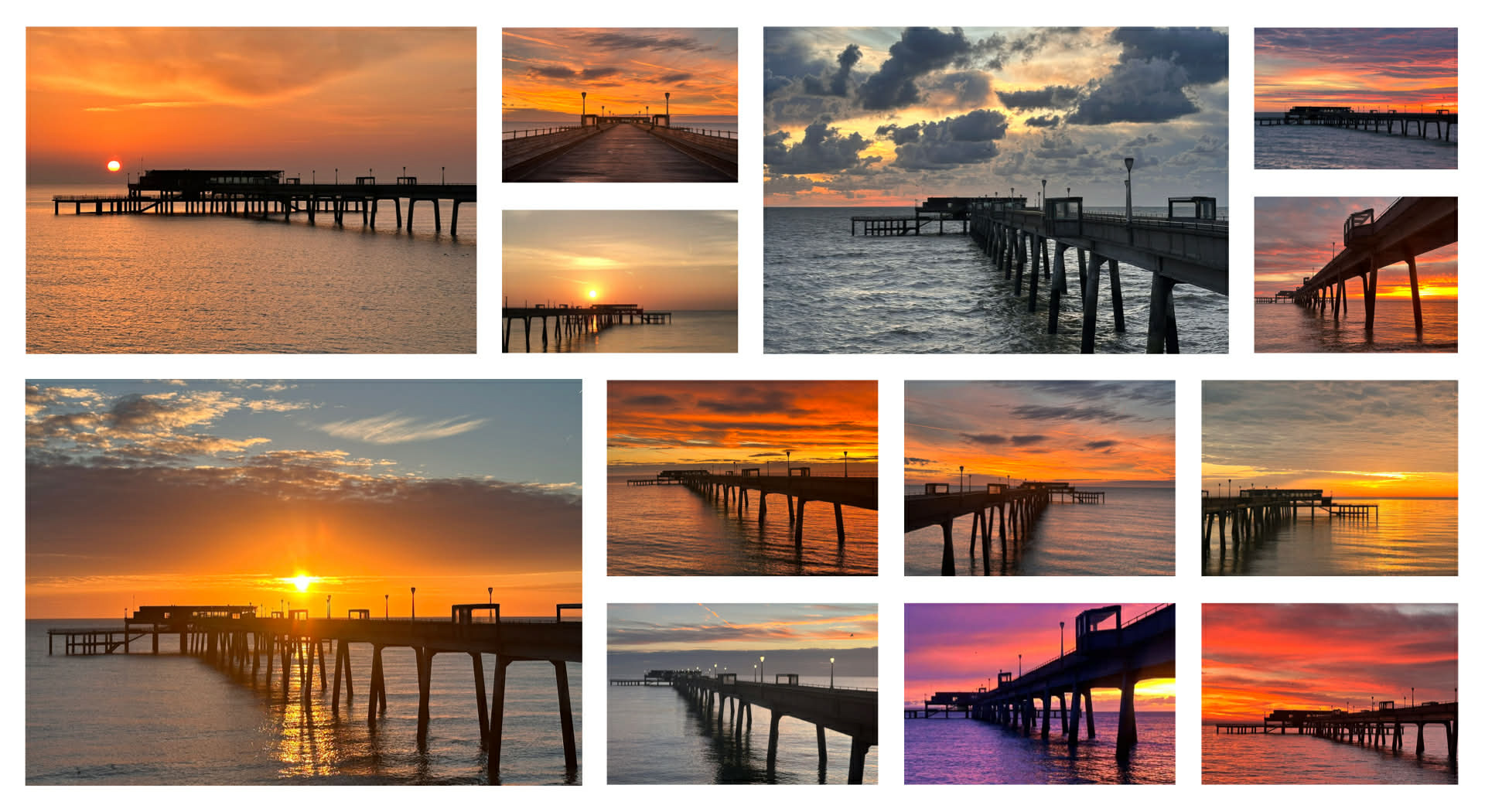

J&J Accountants are excited to be actively displaying our popular ‘Deal Pier’ collection

BEYOND ACCOUNTANCY Commitment to Community and Sponsorship

Beyond accounting, J&J Accountants is dedicated to giving back to the community. The firm proudly sponsors three football teams and a cyclocross league, reinforcing its commitment to local sports and community engagement.

“We believe in the power of community,” says Malpass. “Supporting local sports is just one way we contribute beyond financial services. It’s important to us that we help foster growth not only in businesses but in the wider community as well.

Our Services

Bookkeeping

Financial Accounts

Management Accounts

Company Growth

Personal & Corporate Tax

VAT

Specialist Tax

Payroll Services

Company Secretarial

Business Set-Up

Company Incorporation

Business Health Checks

Quick Tips from J&J Accountants Helpling Kent business stay financially smart

Frequently Asked Questions: J&J Accountants

Contact us today for your first free consultation Expert Friendly Advice

Send us a Message

Contact Information

Our Office